💸 Custom Lending Platform Development

💸 Loan Origination & Application Management

💸 Repayment Tracking & Collection Systems

💸 Document Management & Compliance Tools

💸 Borrower Portals & Mobile Apps

💸 Lending Marketing & Customer Analytics

💸 Agent & Partner Collaboration Tools

💸 Customer Support & Feedback Systems

💸 Multi-Channel Loan Application Portals

All-in-One Digital Solution for the Lending Industry

Why Choose Us

Why Digitalization is Essential for the Lending Industry

In today’s financial landscape, the lending industry thrives on speed, trust, and transparency. Borrowers expect quick approvals, simple digital applications, and clear repayment options, while lenders need secure systems, accurate data, and scalable platforms to stay competitive in an ever-changing market.

Digitalization gives lenders and borrowers the best of both worlds. Automated loan management systems streamline everything from application to disbursement, cutting processing times from days to minutes. Data and reporting tools support smarter decision-making, fraud detection, and customer insights, while cloud-powered platforms manage thousands of loans seamlessly without downtime.

For lenders, this means lower costs, fewer errors, and stronger compliance tracking. For borrowers, it means faster service, flexible options, and a stress-free borrowing experience.

At Amigoways, we build tailored digital solutions for banks, NBFCs, microfinance institutions, and peer-to-peer platforms. From loan origination systems (LOS) and repayment portals to risk management dashboards and mobile-friendly borrower apps, we create technology that drives efficiency, transparency, and growth.

- App Prototyping

- Faster Deployment

- High ROI with lesser cost

About Us

About Amigoways Lending Industry Solutions

At Amigoways, we build reliable, easy-to-use digital solutions tailored for the lending industry. Whether you manage personal loans, business financing, micro-lending, or peer-to-peer lending, our platforms help simplify processes, reduce paperwork, and serve customers faster.

We understand the unique challenges in lending, from secure loan applications and accurate credit tracking to repayment management and strict compliance standards. Our platforms bring everything together in one seamless system so lenders, borrowers, and teams can work with confidence and ease.

Our solutions cover the full spectrum of lending operations. From loan origination and approval workflows to repayment monitoring, customer portals, and compliance-ready reporting, we design platforms that make the entire lending process transparent and stress-free.

Whether you are a bank, an NBFC, a microfinance institution, or a digital-first lender, Amigoways empowers you to approve loans more quickly, reduce errors, monitor repayments effectively, and deliver clear, dependable services to your customers.

With strong security, easy scalability, and mobile-friendly design, we ensure your platform grows smoothly as customer expectations rise and the market evolves. Partner with Amigoways to build a lending solution that is future-ready, trusted, and designed to make lending simple for everyone.

- App Prototyping

- Faster Deployment

- High ROI with lesser cost

Our Services for Lending

Our Services for the Lending Industry

At Amigoways, we understand the fast-changing world of financial services. From digital loan origination to repayment tracking and customer engagement, we deliver tailored software solutions that help banks, NBFCs, microfinance institutions, and peer-to-peer lending platforms improve efficiency, reduce risks, and provide seamless borrowing experiences.

Lending Website Development

We design and develop secure, modern, and mobile-friendly websites for lending companies. Whether you are a bank, NBFC, or micro-lender, your website becomes the first touchpoint for customers to explore loan products, apply online, and track updates. We include features like loan calculators, online application forms, content management, SEO, and full integration with your back-office systems.

Custom Lending Platform Development

We build tailored loan management systems for institutions of all sizes. Whether it’s a digital-first lender, a cooperative society, or a large NBFC, our solutions are designed for scalability, compliance, and user-friendliness.

Loan System Integration & Feature Enhancement

Upgrade your existing lending platform with new capabilities like instant loan applications, EMI calculators, automated approvals, or borrower dashboards without disrupting your current operations.

Document & Data Management System

Securely manage KYC documents, loan applications, repayment proofs, and compliance reports. Track versions, set permissions, and ensure hassle-free information retrieval.

Lending Workflow Management System

Handle loan approvals, credit checks, and compliance processes in one place to save time and ensure accuracy.

Automation & Scheduling Tools for Lenders

Automate repayment reminders, settlement notifications, and loan renewal alerts to cut manual work and improve customer service.

Borrower & Access Rights Management

Easily manage borrower profiles, co-signer details, user roles, and access privileges with built-in security controls.

Real-Time Lending Analytics & Insights

Track disbursements, repayments, overdue accounts, and overall lending performance to make informed business decisions.

Multi-Channel Loan Applications

Enable borrowers to apply for loans via web, mobile apps, branch kiosks, or partner channels with seamless integration.

Mobile Applications for Borrowers & Lenders

Provide borrowers with mobile-friendly apps to apply, track loans, and make repayments, while lenders can monitor portfolios and approve loans quickly.

Payment Gateways & Collection Systems

We offer secure payment options like UPI, cards, wallets, or bank transfers. Automate collections, reminders, and billing processes.

Lending Campaign & Customer Engagement Management

Plan and execute campaigns to promote loan products, festive offers, or refinancing opportunities. Track campaign performance to improve customer acquisition.

Our Development for Lending

Our Development for the Lending Industry

At Amigoways, we don’t just build software, we build trust. From the first loan application to the final repayment, our lending solutions give institutions the tools to serve customers faster, manage risks better, and maintain clear, reliable records. Whether you are a bank, NBFC, microfinance institution, or peer-to-peer platform, our technology helps you speed up approvals, monitor repayments, and create borrowing experiences people can depend on.

Loan Origination & Application Management

Simplify the journey for borrowers and lenders from the very first application.

What We Offer:

Online and mobile loan application forms

Secure document collection and verification

Application tracking dashboards for staff and borrowers

Automated eligibility checks and approval workflows

Multi-branch access with centralized monitoring

Business Impact:

Cut paperwork, shorten approval cycles, and reduce errors while delivering a faster borrower experience.

Use Case:

A regional NBFC reduced loan processing times by 50% after moving to a digital loan origination system.

Loan Event & Repayment Scheduling Tools

Plan, track, and remind customers about their loan installments with ease.

What We Offer:

EMI scheduling and auto-calculations

Repayment reminders via SMS, email, or app

Real-time payment status tracking

Rescheduling options for adjusted terms

Reports for overdue loans and collections

Business Impact:

Improve repayment discipline and reduce defaults by keeping borrowers informed and reminded.

Use Case:

A microfinance company reduced overdue accounts by 45% after adopting automatic repayment reminders.

Partner & Agent Collaboration Hub

Support loan officers, financial agents, and field executives with tools to close deals faster.

What We Offer:

Agent/partner profiles with performance tracking

Lead assignment and loan pipeline visibility

Commission management tools

Secure document and customer onboarding support

Communication tools for faster loan updates

Business Impact:

Boost efficiency, improve sales conversion, and maintain stronger relationships with agents and borrowers.

Use Case:

A lending startup improved disbursement volumes by 30% after digitizing its agent collaboration process.

Customer & Account Management

Organize borrower details into structured profiles to simplify customer service.

What We Offer:

Borrower accounts with loan history and outstanding balances

Secure KYC and compliance data storage

Loan statements available to customers in self-service portals

Support for co-borrowers and guarantors

Automated notifications for renewals and settlements

Business Impact:

Save staff time while improving borrower satisfaction through transparent, accessible account management.

Use Case:

A cooperative bank achieved a 35% drop in service desk queries once customers could access their own loan statements online.

Subscription & Revenue Management for Lending Services

For lenders who offer recurring services and repayment tracking.

What We Offer:

Configurable payment plans (monthly, quarterly, annual)

Automated billing and receipts

Failed payment tracking and reattempt workflows

Revenue summary dashboards for management

Borrower-side portals for flexible repayment

Business Impact:

Streamline collections, improve cash flow, and maintain accurate repayment records.

Use Case:

An NBFC improved its on-time repayment rate by 33% after enabling automated payment scheduling.

Our Benefits of Digital Solutions for Lending

Benefits of Digital Solutions for the Lending Industry

Discover the key benefits of digital lending solutions that make loan processes faster, safer, and easier for everyone. Our digital solutions help banks, NBFCs, and lenders improve efficiency, security, and customer experience.

Increased Revenue Opportunities

With digital lending platforms, institutions can reach more customers through multiple channels. Offering personal loans, business financing, micro-loans, leasing, and quick consumer credit options online helps expand services beyond traditional branch operations. This diversification increases revenue streams while keeping operational costs low.

Better Customer Insights

Digital solutions allow lenders to track customer profiles, repayment history, and borrowing behavior. By understanding which products are most in demand and how clients repay, lenders can design better loan products, improve customer service, and achieve higher borrower satisfaction.

Streamlined Loan Management

From loan origination to repayment, everything can be managed in one system. Applications, approvals, repayment tracking, and compliance checks are handled digitally, reducing paperwork, eliminating delays, and ensuring accurate record-keeping across all branches.

Stronger Customer Loyalty

Features such as quick loan processing, transparent repayment schedules, and timely notifications build trust with borrowers. Satisfied customers are far more likely to return for future loans and recommend your institution to others.

Latest Technologies Built by Experts

We build secure, scalable lending solutions using trusted technologies. For web platforms, we use React, Angular, Next.js, .NET, Python, and Node.js. For mobile applications, we use Flutter, Kotlin, Swift, Java, and React Native to deliver reliable, high-quality apps.

From loan origination and repayment portals to customer dashboards and compliance reporting, we design platforms tailored to each lending institution’s goals. We also work with robust databases such as MongoDB, Firebase, MySQL, and PostgreSQL to handle large loan volumes, store financial records securely, and power real-time reporting.

One Year of Free Support

At Amigoways, delivering your lending platform is only the beginning. We provide one full year of free technical support after launch. Whether updating repayment workflows, improving user experience, or integrating new payment options, our team ensures your system runs smoothly.

We keep your lending platform secure, fast, and reliable, while you focus on serving customers, expanding your services, and meeting compliance standards.

Faster and Simpler Borrowing Experience

Borrowers can apply for loans, upload documents, and track approvals online instead of visiting multiple branches. Repayment reminders and digital receipts make repayment simpler and stress-free.

Clear and Transparent Services

Digital platforms provide borrowers with easy access to repayment timelines, outstanding balances, and past transactions. Transparency reduces confusion and fosters a trustworthy relationship between lenders and borrowers.

Flexible Access to Lending Services

Customers can apply for loans through websites, mobile apps, or even kiosks. This flexibility allows them to choose the most convenient way to access lending services, making it easier to serve both urban and rural borrowers.

Secure Transactions and Privacy Controls

Strong security measures ensure that borrower data, repayment information, and financial records are protected at all times. Strict access controls and encryption protect sensitive information while keeping your systems compliant with financial regulations.

Our Mission, Your Trust

Modern Digital Solutions for the Lending Industry

At Amigoways, we help lending institutions simplify finance and serve customers with speed and transparency. Our mission is to deliver digital solutions that make loan management easier, improve customer experiences, and reduce operational stress – so you can focus on growing your lending portfolio, building trust, and supporting financial inclusion.

Experts in Lending Technology

We understand the changing needs of the lending world - from quick loan applications and secure disbursements to repayment collections and compliance management. Our team builds digital tools that allow lenders to track loans, manage customers, and bring everything together in one reliable system.

Tailored Systems Built for Your Lending Process

No two lenders operate the same way. We design platforms that fit your business model - whether it’s retail lending, business loans, microfinance, or peer-to-peer. Our solutions cover application processing, repayment tracking, customer service, and compliance, ensuring smooth integration into your daily operations.

Simplifying Loan & Customer Management

Managing loans doesn’t have to be complicated. Our software helps you process applications, approve loans, track repayment schedules, and maintain borrower records in one place. With mobile access and easy-to-use dashboards, your team can respond faster and serve customers without delays.

Scalable Platforms Powered by Advanced Tech

We build future-ready lending platforms using secure, modern technologies and cloud infrastructure. Whether you’re expanding into new markets, handling higher loan volumes, or introducing new loan products, your system stays flexible, reliable, and built for growth.

Connected Ecosystems for Teams & Partners

Keep your loan officers, branch staff, collection agents, and finance partners aligned. Our platforms allow for instant updates, faster approvals, and smoother collaboration, reducing delays and helping your lending operations run without interruption.

Secure, Compliant, and Reliable Systems

Data security and compliance are essential in finance. We protect sensitive borrower information, loan transactions, and financial records with encryption, strict access controls, and compliance-ready reporting. From KYC verification to audit trails, our systems help you stay compliant and trusted.

Our Lending Websites & Applications

Our Lending Websites & Apps

At Amigoways, we build reliable, high-performance websites and mobile apps designed for the lending industry. From digital loan application portals to repayment tracking systems, our solutions make lending processes faster, clearer, and more convenient for both customers and financial institutions. We focus on secure functionality, user-friendly design, and scalable features that support growth and compliance. Whether you’re a bank, NBFC, microfinance institution, or peer-to-peer lending platform, our websites and apps are tailored to streamline loan applications, improve communication with borrowers, simplify collections, and deliver a seamless experience across devices.

6Boost UK

6Boost UK specializes in high-performance automotive parts and upgrades. We developed a sleek, fast-loading website optimized for showcasing products with detailed specifications, high-resolution images, and easy navigation. The platform supports secure online transactions, real-time stock updates, and customer account features that make purchasing seamless from desktop or mobile.

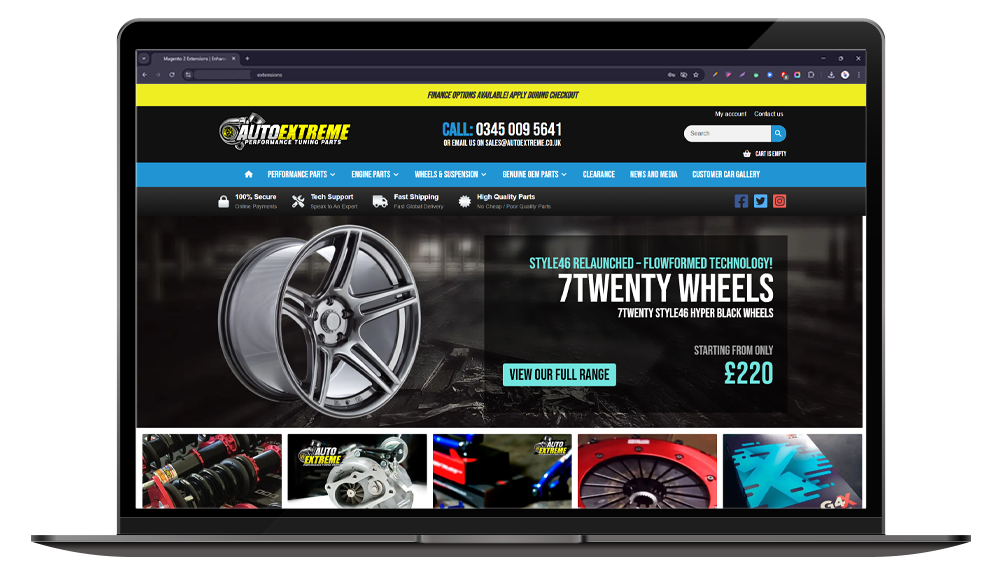

Auto Extreme Ltd

Auto Extreme Ltd, a leader in supplying after market wheels, suspension, and specialist auto parts, needed a powerful e-commerce site designed for speed and reliability. We created a platform with advanced product filtering, VIN-based fitment search, and integrated payment systems giving customers a smooth browsing and buying experience while enabling the business to manage inventory and orders effortlessly.

Our Development

Types of Jewellery & Digital Gold Industry Apps We Developed

Amigoways develops tailored apps for the Jewellery and Digital Gold industry, including eCommerce platforms, digital gold investment solutions, inventory management systems, and customer engagement tools

Digital Gold Platforms

We develop robust platforms for buying, selling, and managing digital gold investments. These apps provide real-time price updates, secure transactions, and portfolio management tools, catering to both individual investors and institutional clients.

Jewellery Design and Customization Apps

Our apps enable users to design and customize jewellery pieces virtually. Features include 3D visualization, gemstone selection, and personalized engravings, allowing customers to create unique, bespoke jewellery from their devices.

Inventory Management Systems

We offer advanced inventory management solutions for jewellers and gold traders. These apps help track stock levels, manage supply chains, and forecast demand, ensuring efficient operations and reduced inventory costs.

Augmented Reality (AR) Try-On Apps

Our AR apps allow customers to virtually try on jewellery pieces before purchasing. Using a smartphone or tablet, users can see how different designs look on them, enhancing the online shopping experience and increasing engagement.

Blockchain-Based Provenance Tracking Apps

We create apps that leverage blockchain technology to provide transparent tracking of jewellery and digital gold provenance. These apps ensure authenticity and secure ownership records, fostering trust and confidence among buyers.

Digital Wallets for Gold Assets

We develop secure digital wallets for storing and managing digital gold assets. These wallets offer features like transaction history, real-time valuation, and secure access controls, facilitating smooth and safe gold transactions.

Jewellery Marketplace Apps

Our marketplace apps connect buyers and sellers of jewellery and digital gold. They include features such as product listings, reviews, and secure payment gateways, offering a seamless and interactive buying and selling experience.

Custom Web Development

We provide apps that use AI to offer personalized investment advice in the gold market. These apps analyze market trends and individual preferences to recommend tailored investment strategies and portfolio adjustments.

Customer Relationship Management (CRM) Systems

Our CRM apps are designed for jewellery businesses to manage customer relationships effectively. They include tools for tracking interactions, managing customer data, and automating marketing campaigns to improve client engagement and retention.

Get in touch

We Provide Best Services. Need Help?

Simple To Get Started

To Start Your Business, contact us Now!

Call For Active Now

+91-99439-04056

+91-99439-04057

Say Hello

sales@amigoways.com

support@amigoways.com

Looking For Business Growth?

What kind of help do you need today?