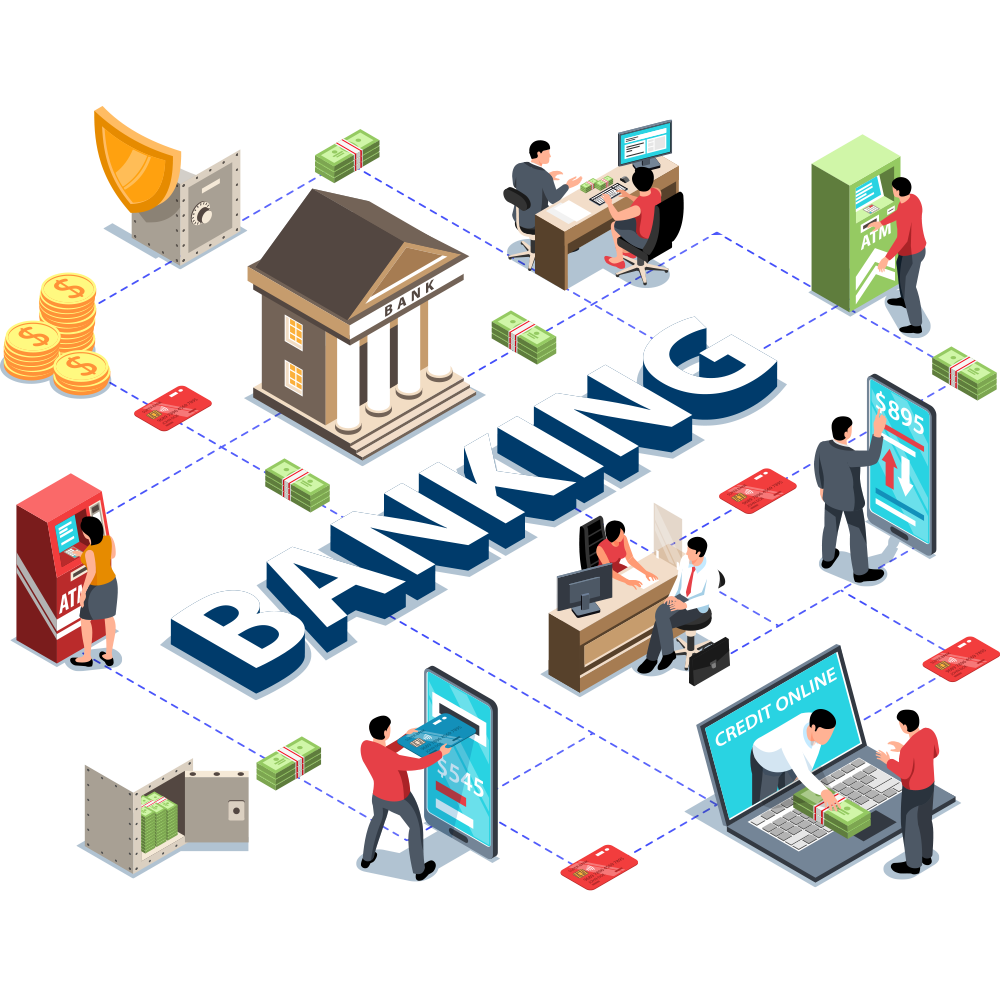

Fintech & Banking

🏦 Finance Website Development

🏦 Banking CRM Software Development

🏦 Loan Management Application Development

🏦 Core Banking Infrastructure Development

🏦 Payment Gateway Integration

🏦 KYC & eKYC Automation

🏦 Chatbot & Customer Support Automation

🏦 Investment & Wealth Management App

Why Choose Us

Why Digitalization is Essential for Fintech & Banking

In today’s digital age, people expect fast, convenient and secure access to financial services. Digitalization helps fintech and banking companies provide user-friendly platforms like mobile apps and online portals where customers can check balances, transfer money, pay bills and apply for loans, all from the comfort of their homes.

Digital tools also improve internal banking processes. Automation reduces paperwork, minimizes errors and speeds up daily operations. With advanced features like real-time alerts and AI-powered fraud detection, banks can offer safer and more efficient services while cutting down operational costs.

As customer expectations grow and competition increases, digital transformation is no longer optional. It allows financial institutions to stay ahead, offer better user experiences and build long-term trust with clients in a tech-driven world.

- App Prototyping

- Faster Deployment

- High ROI with lesser cost

About Us

About Amigoways Fintech & Banking Solutions

At Amigoways, we specialize in delivering smart and secure digital solutions for the Fintech and Banking industry. Our services are designed to help banks, NBFCs and finance startups streamline operations, enhance customer engagement and drive digital growth. From mobile banking apps to secure payment gateways and loan management systems, our solutions are built to meet the evolving needs of modern finance.

We focus on automation, security and real-time data processing to help institutions improve efficiency and reduce operational risks. With features like AI-driven analytics, KYC integrations, customer dashboards and multi-channel access, we enable businesses to offer seamless, user-friendly financial services.

Backed by a team of certified professionals and the latest tech stack, Amigoways ensures scalable, compliant and future-ready financial software that empowers your digital transformation journey.

- App Prototyping

- Faster Deployment

- High ROI with lesser cost

Our Services for Fintech & Banking

Our Services for Fintech & Banking Industry

At Amigoways, we offer a comprehensive suite of digital solutions tailored for the modern financial ecosystem. Our services are designed to enhance operational efficiency, improve customer engagement and ensure compliance with industry standards.

Mobile Banking App Development

We specialize in developing secure, user-centric mobile banking applications that provide seamless access to banking services. Users can effortlessly check account balances, transfer funds, pay bills and manage transactions, all from the convenience of their smartphones. Our apps are built with advanced security protocols, intuitive interfaces and real-time data synchronization.

Digital Wallet & UPI Integration

Transform your payment experience with our feature-rich digital wallet solutions and seamless UPI integration. Designed for speed and security, our systems support peer-to-peer money transfers, QR code payments, in-store purchases and online transactions, enabling users to make payments effortlessly and businesses to scale cashless operations.

Loan Management Application

Our loan management platforms streamline every phase of the lending process, from loan origination and credit assessment to approval, disbursement, and repayment tracking. With robust reporting tools, EMI scheduling and automated reminders, our solution ensures transparency and efficiency in managing both secured and unsecured loans.

Banking CRM Development

Deliver outstanding customer experiences with our customized banking CRM solutions. We help financial institutions manage client interactions, track leads, automate follow-ups and analyze customer behaviour, all through a centralized platform. The result is improved client relationships, higher retention and more personalized banking services.

Payment Gateway Integration

Facilitate secure, fast and flexible payment processing by integrating leading payment gateways into your platforms. We support a wide range of payment methods including credit/debit cards, net banking, UPI and digital wallets. Our integrations are PCI-DSS compliant, ensuring safe handling of sensitive payment data.

KYC & eKYC Automation

Accelerate your onboarding process with our KYC and eKYC automation systems. Our solutions enable digital identity verification using OCR, biometric authentication, Aadhaar eKYC APIs and document scanning, ensuring full compliance with regulatory guidelines while reducing manual verification efforts.

Chatbot & Customer Support Automation

Enhance your customer service capabilities with intelligent, AI-driven chatbots. Available 24/7, these bots can handle FAQs, guide users through processes, resolve queries and even escalate complex issues to human agents. This improves response times, reduces operational costs and boosts overall user satisfaction.

Investment & Wealth Management Apps

Empower your customers to manage their finances with confidence using our investment and wealth management applications. These tools offer portfolio tracking, goal-based savings, market insights, advisory features and risk assessments, helping users make informed financial decisions with ease.

Core Banking System Development

We build robust and scalable core banking systems that serve as the foundation of financial operations. Our solutions manage account creation, transaction processing, fund transfers, interest calculations, compliance tracking and audit-ready reporting, ensuring secure and efficient core banking operations.

Insurance Management Platforms

Simplify insurance operations with our comprehensive platforms that support policy creation, renewal management, premium collection, claims processing and customer communication. Our solutions enhance productivity, reduce manual errors and deliver seamless digital experiences to policyholders and agents alike.

Recurring Payment & Subscription Billing Application

Enable automated billing with our subscription management systems. Ideal for businesses offering recurring services, our solution handles auto-debits, invoicing, customer notifications and payment tracking, ensuring timely collections and reducing payment failures.

Agent & Field Executive Management App

Efficiently manage your on-ground workforce with our specialized mobile applications for agents and field staff. Track real-time locations, assign tasks, monitor collections, capture daily reports and enhance accountability, all through a centralized dashboard.

Our Development for Fintech & Banking

Our Development for the Fintech & Banking Industry

We specialize in providing comprehensive digital solutions tailored to the evolving needs of the financial sector. Our fintech and banking development services are designed to deliver innovation, enhance customer experiences and ensure operational excellence.

Banking Mobile App Development

We build robust, secure and intuitive mobile applications designed specifically for banks, NBFCs, fintech startups and wealth management firms.

Our mobile apps include features such as:

Account balance viewing and transaction history

Fund transfers, bill payments and QR-based transactions

Push notifications and biometric authentication

In-app customer support and chatbot integration

Finance Website Development

We specialize in building secure, scalable and feature-rich web solutions for banks, NBFCs, fintech startups and other financial institutions.

Our finance web development services include:

Responsive sites for finance & onboarding

Dashboards for transactions, statements & loans

Secure payment gateways with PCI-DSS compliance

Integrated financial calculators (EMI, savings, investment returns)

KYC & document verification modules

Real-time analytics and performance tracking dashboards

Admin panels for user management, compliance and reporting

With a strong focus on security, compliance and user experience, we help financial businesses go digital and grow faster.

Banking CRM Software Development

We design intelligent CRM platforms for banks and NBFCs to enhance customer engagement and streamline operations.

Our CRM solutions include:

Centralized customer profiles for complete visibility

Lead management with automated follow-ups and reminders

Interaction tracking across all customer touchpoints

Relationship manager dashboards with actionable insights

Custom workflows for sales, onboarding and retention

Data analytics and reporting for performance monitoring

These solutions help increase customer satisfaction, retention and cross-selling opportunities.

Loan Management Application Development

We build robust loan management systems to digitize the full loan lifecycle for banks, NBFCs and financial institutions.

Our application features include:

Online loan application with KYC and document uploads

Eligibility checks and automated credit scoring

Loan approval workflows with compliance integration

EMI scheduling and repayment tracking

Borrower portal with real-time status updates

Alerts & notifications for dues, disbursements and collections

Our platform ensures accuracy, transparency and control across your loan operations.

Core Banking Infrastructure Development

We create powerful and scalable digital infrastructures tailored for banks, NBFCs and fintech enterprises.

Our services include:

Real-time core banking system architecture

Centralized customer information management

Integrated general ledger and financial accounting

High-speed transaction processing engines

Automated interest, fee and reporting modules

Role-based access controls for secure internal operations

Open APIs for seamless third-party system integration

Our platforms are secure, compliant and built to support your growing operational needs.

Our Benefits of Digital Solutions for Fintech & Banking

Benefits of Digital Solutions for Fintech & Banking Industry

Unlock the full potential of your financial services with secure, scalable, and future-ready digital solutions. Our fintech and banking platforms streamline onboarding, optimize transactions, and help institutions deliver tailored, compliant, and seamless customer experiences.

Faster Operations

Digital solutions streamline various banking activities such as loan processing, fund transfers, KYC verification and account management. Automation tools reduce human errors and accelerate workflow, allowing financial institutions to serve more customers efficiently and stay ahead of competitors in a fast-paced environment.

Lower Operational Costs

By digitizing core services, financial institutions reduce dependency on physical paperwork, printing, manual data entry and branch-based services. This leads to substantial savings in labour costs, infrastructure and maintenance. Technologies like AI-driven customer support, cloud-based platforms and automated processing eliminate redundant tasks and improve overall ROI.

Improved Customer Service

Digital tools such as chatbots, self-service portals and mobile banking apps allow banks to assist customers instantly. With features like real-time support, transaction tracking and quick feedback systems, customer satisfaction increases. Personalized financial recommendations based on user behaviour also help build long-term loyalty.

Real-Time Data & Smart Insights

Advanced analytics platforms give financial businesses instant access to customer behaviour trends, market movements, performance metrics and compliance reports. Real-time dashboards and reporting tools help management make data-driven decisions, minimize risks, improve services and adapt quickly to changes in regulations or user needs.

Latest Technologies Built by Experts

We develop secure, scalable fintech and banking platforms using the latest technologies. Our expert team utilizes React, Angular, Next.js, .NET, Python, Node.js and mobile-first frameworks like Flutter, Kotlin, Swift, Java, and React Native to build seamless user experiences across web and mobile platforms.

For powerful backend architecture and real-time data handling, we integrate databases such as MongoDB, Firebase, MySQL and PostgreSQL, ensuring high performance, security and compliance in financial operations.

Our solutions are tailored to meet regulatory standards, offer frictionless transactions, and scale effortlessly as your business grows. To round off our tech stack, we also work with PHP and Laravel to meet diverse development needs.

One Year of Free Support

With Amigoways, our partnership doesn’t end at launch. We offer one full year of free support for your fintech or banking application post-deployment. During this time, our dedicated support team handles updates, bug fixes and ensures uninterrupted financial services.

From minor UI enhancements to resolving transaction errors or backend improvements, we’re always on hand to help. Our goal is to ensure your platform runs seamlessly, delivers flawless user experiences, and remains compliant with security protocols so you can focus on expanding your financial services while we handle the tech backbone.

Bank-Grade Safety

Fintech platforms are built with strong safety measures like multifactor authentication (MFA), end-to-end encryption, biometric login systems and fraud detection tools. These advanced features help protect users’ personal and financial data, ensuring secure transactions and building user trust in digital financial services.

Simple and Friendly Experience

Modern apps and websites are designed with user-friendly interfaces, intuitive navigation and easy access to services. Features like voice commands, regional language support and clear visual indicators make banking easier even for first-time users or those less familiar with technology.

Access Anytime, Anywhere

With mobile and online banking, customers can perform essential banking tasks 24/7 whether it’s transferring money, checking balances, paying bills, or applying for loans. This level of convenience improves user satisfaction and reduces dependency on branch visits or business hours.

Quick Approvals and Services

Digital onboarding and

AI-powered systems speed up processes like loan approvals, KYC checks and new account openings. What once took days or weeks can now be completed within minutes, enhancing the user experience and encouraging more people to adopt digital banking services.

Our Mission, Your Success

Smart Fintech & Banking Solutions for the Digital Age

Discover how Amigoways empowers banks, NBFCs, and financial institutions with next-gen digital tools to stay agile, compliant, and customer-first.

Industry-Certified Experts

Our fintech developers and consultants bring in-depth domain knowledge and technical expertise to craft secure, regulation-ready digital solutions for banks and financial firms.

Fully Custom-Built Solutions

We tailor each platform to your unique financial workflows from lending and payments to compliance and customer engagement ensuring seamless integration and scalability.

Creative Financial Innovation

We turn complex banking challenges into easy-to-use digital experiences. From UPI wallets to wealth management apps, we help you deliver services your customers love.

Future-Ready Technologies

Whether it’s mobile-first architecture, cloud computing, or real-time data processing, we build fintech systems that grow with your business and meet evolving digital demands.

End-to-End Customer Engagement

From onboarding to support, we help you build intelligent engagement systems that improve customer satisfaction, reduce service costs, and encourage retention.

Enterprise-Grade Security & Compliance

All our solutions are built with bank-level encryption, fraud detection systems, KYC/eKYC compliance, and audit-ready frameworks aligned with RBI and global standards.

Our Fintech & Banking Applications & Websites

Our Fintech & Banking Industry Website & Apps

Amigoways drives digital transformation in Fintech & Banking. We develop secure, scalable web and mobile applications that empower financial institutions to deliver seamless services, enhance customer experiences, and thrive in the digital financial sector. Our solutions range from banking software and investment platforms to secure payment gateways and digital gold ecosystems.

Bankvallet

Bankvallet appears to be a platform facilitating various financial services, primarily focused on connecting individuals and businesses with loan schemes from different banks and financial institutions. It likely serves as a lead generation or consultation service for a range of financial products, including personal loans, home loans, and business loans.

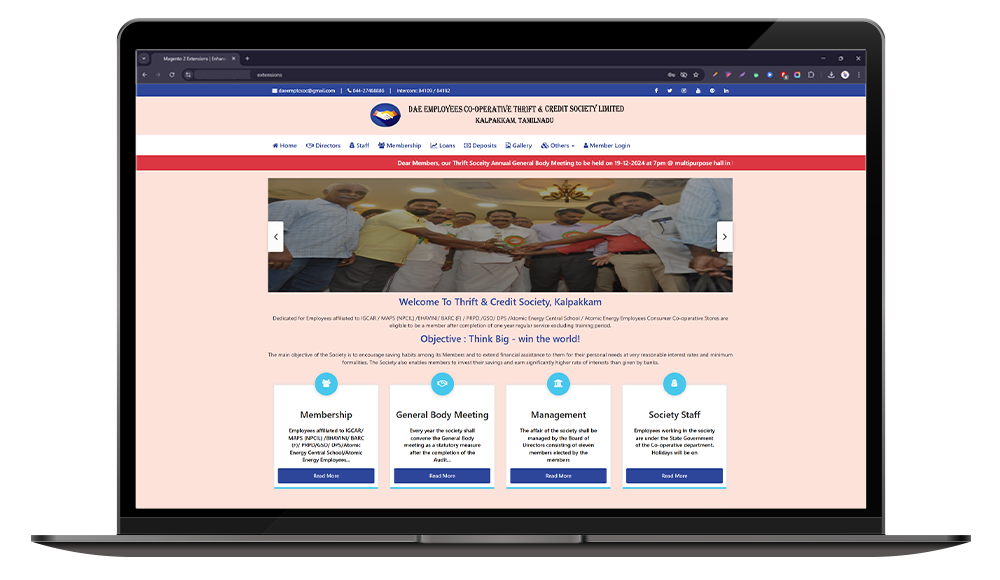

Kalpakkam Thrift Society

The Kalpakkam Thrift & Credit Society is a cooperative financial institution established in 1974, dedicated to serving employees affiliated with the Department of Atomic Energy (DAE) units in Kalpakkam, such as IGCAR, MAPS, and BHAVINI. Its primary objectives are to encourage saving habits among members and provide financial assistance through various loan schemes, including long-term loans, educational loans, jewel loans, and loans against National Saving Certificates (NSCs), all at reasonable interest rates.

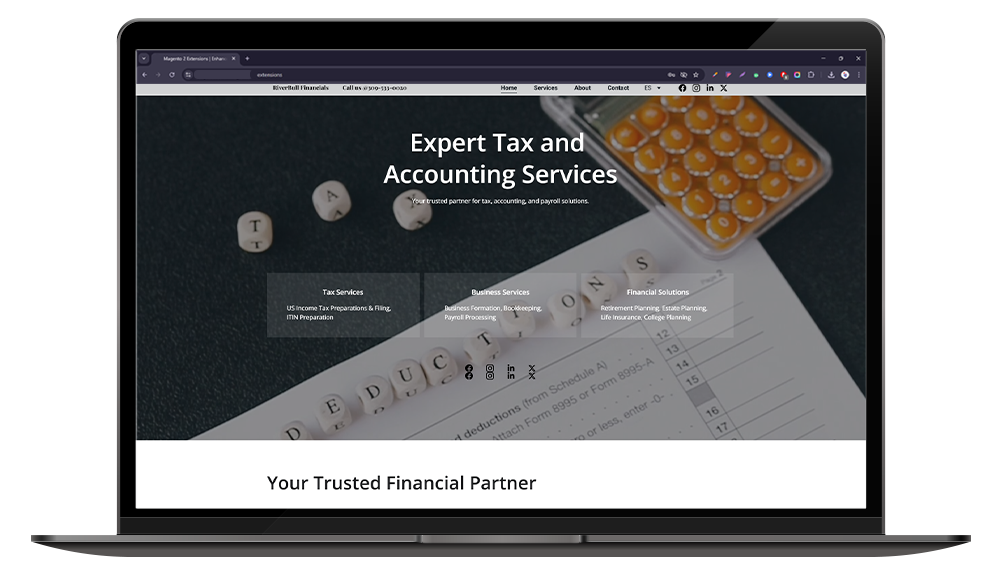

RiverBull Financials

RiverBull Financials is a professional services firm specializing in tailored tax, accounting, and payroll solutions for businesses. They offer comprehensive financial services designed to help businesses manage their finances efficiently, ensure compliance, and maximize resources for sustainable growth and prosperity. Their services include US income tax preparations and filing, ITIN preparation, business formation, bookkeeping, and payroll processing.

Our Development

Types of Jewellery & Digital Gold Industry Apps We Developed

Amigoways develops tailored apps for the Jewellery and Digital Gold industry, including eCommerce platforms, digital gold investment solutions, inventory management systems, and customer engagement tools

Digital Gold Platforms

We develop robust platforms for buying, selling, and managing digital gold investments. These apps provide real-time price updates, secure transactions, and portfolio management tools, catering to both individual investors and institutional clients.

Jewellery Design and Customization Apps

Our apps enable users to design and customize jewellery pieces virtually. Features include 3D visualization, gemstone selection, and personalized engravings, allowing customers to create unique, bespoke jewellery from their devices.

Inventory Management Systems

We offer advanced inventory management solutions for jewellers and gold traders. These apps help track stock levels, manage supply chains, and forecast demand, ensuring efficient operations and reduced inventory costs.

Augmented Reality (AR) Try-On Apps

Our AR apps allow customers to virtually try on jewellery pieces before purchasing. Using a smartphone or tablet, users can see how different designs look on them, enhancing the online shopping experience and increasing engagement.

Blockchain-Based Provenance Tracking Apps

We create apps that leverage blockchain technology to provide transparent tracking of jewellery and digital gold provenance. These apps ensure authenticity and secure ownership records, fostering trust and confidence among buyers.

Digital Wallets for Gold Assets

We develop secure digital wallets for storing and managing digital gold assets. These wallets offer features like transaction history, real-time valuation, and secure access controls, facilitating smooth and safe gold transactions.

Jewellery Marketplace Apps

Our marketplace apps connect buyers and sellers of jewellery and digital gold. They include features such as product listings, reviews, and secure payment gateways, offering a seamless and interactive buying and selling experience.

Custom Web Development

We provide apps that use AI to offer personalized investment advice in the gold market. These apps analyze market trends and individual preferences to recommend tailored investment strategies and portfolio adjustments.

Customer Relationship Management (CRM) Systems

Our CRM apps are designed for jewellery businesses to manage customer relationships effectively. They include tools for tracking interactions, managing customer data, and automating marketing campaigns to improve client engagement and retention.

Get in touch

We Provide Best Services. Need Help?

Simple To Get Started

To Start Your Business, contact us Now!

Call For Active Now

+91-99439-04056

+91-99439-04057

Say Hello

sales@amigoways.com

support@amigoways.com

Looking For Business Growth?

What kind of help do you need today?